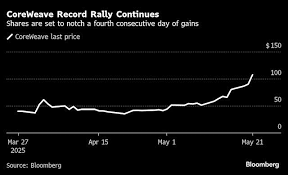

CoreWeave Inc. has been making headlines as its stock soars, defying analyst predictions and reaching record highs. The company's explosive rally has caught the attention of investors and analysts alike. Citi Research recently doubled their 12-month price target on CoreWeave's stock, only to see it blown past by the market within minutes of trading opening. What is driving this remarkable surge in the stock price?

Marquee partnerships, a positive revenue outlook, and a renewed interest in artificial intelligence cAIc have been key factors propelling CoreWeave to new heights. Despite some skepticism from Wall Street, the company's stock has been on a continuous upward trajectory, more than doubling from its IPO price in late March. The recent first quarterly earnings report impressed analysts, with revenue beating expectations and allaying concerns about demand.

The announcement of a significant deal with OpenAI, worth up to $4 billion, further fueled optimism among bullish investors. However, not all analysts are convinced of CoreWeave's long-term potential. Some point out that the company's earnings were mixed, leading to a temporary dip in the share price following a downgrade by D.A. Davidson. Concerns exist about the stock being overvalued, with an average analyst price target suggesting a potential 40% decline in the next 12 months.

Despite the current optimism surrounding CoreWeave, caution remains among some market observers. Only 13% of the company's shares are available for trading, indicating a low float, while over 40% of the stock's float has been used for short selling. Analysts, including those at Citi, are looking for more progress on profitability and customer diversification to justify the recent rally.

CoreWeave's success is part of the broader trend in AI stocks, which are seen as key players in the future of technology and innovation. The company's specialization in providing cloud infrastructure and services tailored for AI and accelerated computing workloads has set it apart from larger competitors like Amazon and Microsoft. CoreWeave's recent acquisition of AI developer platform Weights & Biases further enhances its offerings in the AI space.

The stock's current valuation at 16 times sales reflects the market's optimism about its growth potential. While CoreWeave is not yet profitable on a GAAP basis, its strong revenue growth and strategic acquisitions have positioned it as a player to watch in the AI sector. Investors considering CoreWeave should weigh the risks and potential rewards carefully, especially given the stock's high valuation and the competitive landscape in the AI industry.

Looking ahead, the question remains: Can CoreWeave turn a $10,000 investment into $1 million by 2035? While such astronomical returns are rare, the company's growth prospects and leading position in the AI market suggest that it could offer significant upside. As the AI industry continues to expand, CoreWeave's success story may just be beginning. Investors should stay informed and vigilant as they consider the opportunities and risks presented by this dynamic and fast-growing sector.