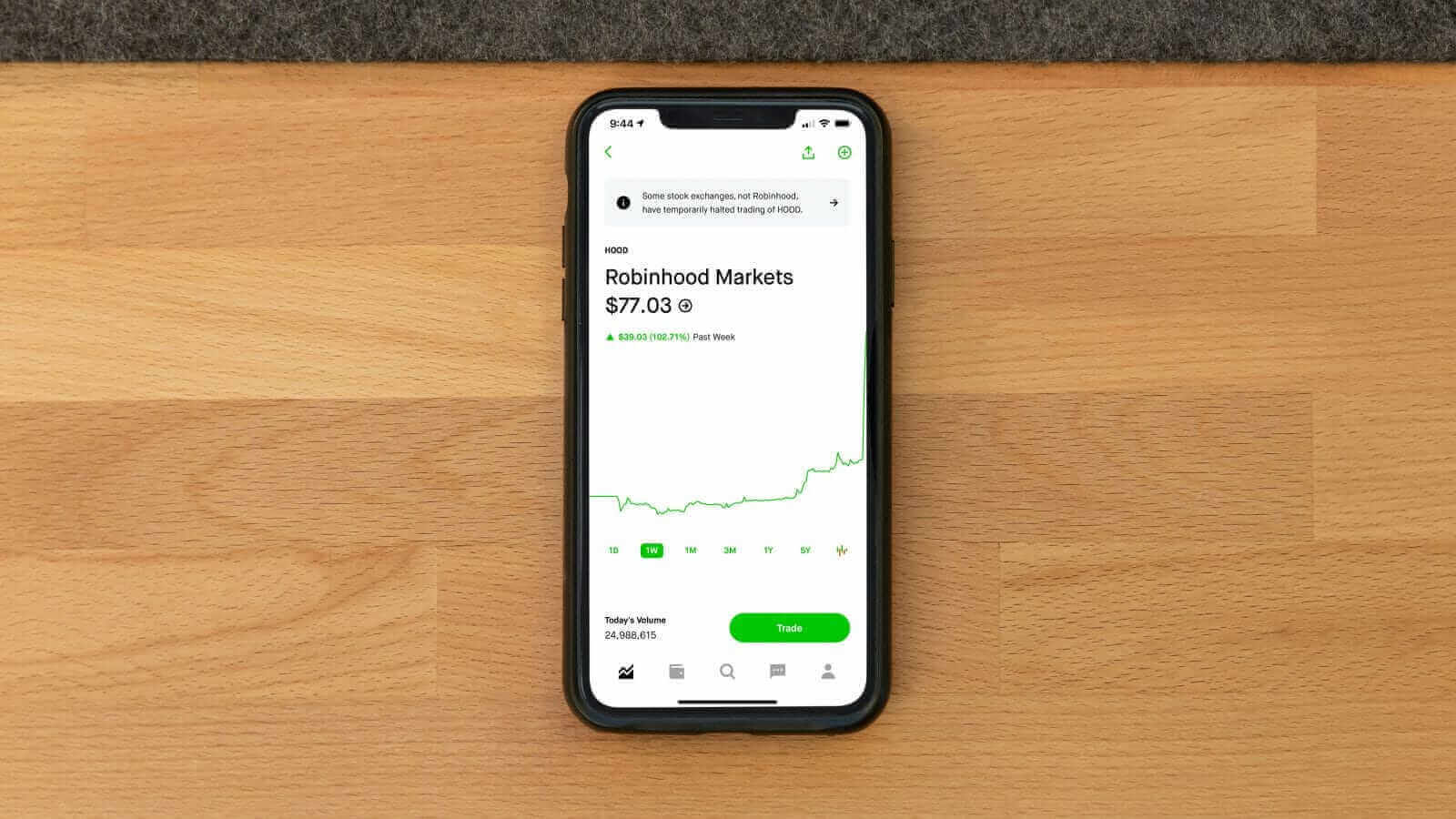

Robinhood cHOODc has recently made a groundbreaking move by surpassing a $100 billion market cap milestone. This achievement comes as the stock price has soared over 200% this year, reflecting a strong investor belief in the company's financial performance and strategic vision.

In the second quarter of 2025, Robinhood demonstrated outstanding performance by exceeding the Zacks Consensus Estimate with earnings of 42 cents per share, a doubling year-over-year improvement. This growth was primarily fueled by robust transaction-based revenues, which saw a 65% increase, and net interest revenues, which rose by 25%. Currently, Robinhood serves 26.5 million funded accounts, holding over $279 billion in assets under custody, marking a substantial 41% year-over-year growth.

The company's expansion into various sectors, such as crypto and tokenized stocks, combined with strategic moves like launching tokenized U.S. stocks in Europe and acquiring Bitstamp, a well-known global crypto exchange, have caught the attention of investors.

In crossing the $100 billion threshold, Robinhood has not only achieved scale but has also garnered increased attention from analysts, institutions, and index funds. Speculations are rising that HOOD stock could soon be included in the prestigious S&P 500 Index, following in the footsteps of Coinbase Global, which currently boasts a market cap of $79.8 billion.

Competing with Robinhood for a spot in the S&P 500 Index is Interactive Brokers Group, which currently holds a market cap of $112 billion. Despite its recent surge, Robinhood faces challenges such as regulatory scrutiny, volatility in crypto revenues, and strong competition from both traditional brokerages and emerging fintech firms like Coinbase and Interactive Brokers. However, exceeding the $100 billion mark solidifies Robinhood's position among the world's top fintech platforms, showcasing a significant transformation from its meme-stock origins in 2021 to a major player in the financial industry.

With its impressive price performance, HOOD shares are currently trading at a substantial premium compared to the industry average. The company's robust outlook can be seen through the Zacks Consensus Estimate for 2025 and 2026, suggesting year-over-year growth projections of 39.5% and 21.5%, respectively. Recent upward revisions to earnings estimates further indicate positive market sentiment towards Robinhood.

The market response to Robinhood's success is evident in its Zacks Rank #1 cStrong Buyc designation, reflecting strong potential for future growth and performance. This underscores the confidence of analysts and investors in Robinhood's trajectory within the financial market landscape.

In conclusion, Robinhood's ability to break the $100 billion market cap barrier showcases the company's resilience and growth trajectory as a prominent player in the fintech industry. With strategic acquisitions, innovative offerings, and a focus on expanding its market reach, Robinhood is poised for continued success on a global scale.

For those interested in exploring further investment opportunities, staying informed about the latest recommendations from financial research institutions like Zacks Investment Research can provide valuable insights into potential market movers and investment prospects. Robinhood's journey towards becoming a dominant force in the financial sector exemplifies the transformative power of innovation and strategic vision in shaping the future of fintech.

As with any investment decision, it is crucial for investors to conduct thorough research and seek professional guidance to make informed choices that align with their financial goals and risk tolerance. Robinhood's ascent to a $100 billion market cap represents not just a milestone, but a testament to the company's capacity to navigate dynamic market conditions and emerge as a key player in the evolving landscape of fintech.