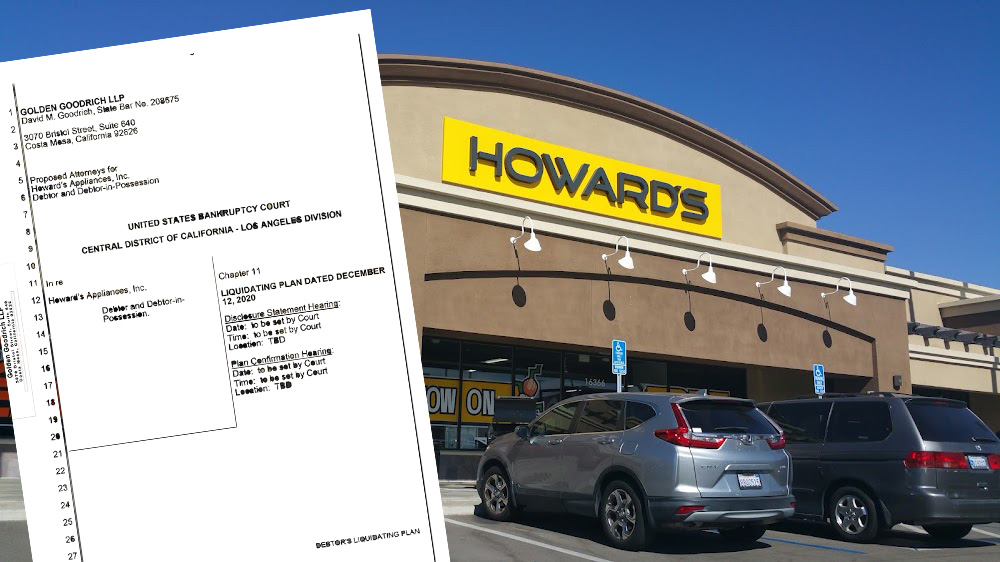

Howard’s Appliance, a long-standing and well-known retailer in Southern California, has recently filed for Chapter 11 bankruptcy, leaving many customers and employees shocked by the abrupt closure of its 17 locations. The company's decision to shut down its operations came just after the busy Black Friday period, catching both staff and consumers off guard with little notice.

The bankruptcy filing, spearheaded by David Goodrich from the Golden Goodrich law firm, cited challenges such as tariffs, declining consumer spending, and broader macroeconomic issues as driving factors behind the company's financial troubles. The sudden closure of the stores left customers who had recently made purchases grappling with uncertainty, as some struggled to reach the company for information on their orders.

The move sparked a buzz on social media, with reports of customers facing difficulties in obtaining their purchases and encountering closed stores. Previous closures of stores by Howard’s Appliance, such as the one in Upland, California, in 2020, hint at the challenges the company had been facing even before its latest bankruptcy filing.

The bankruptcy filing itself shed light on Howard's financial situation, revealing a significant disparity between assets and liabilities. With total liabilities exceeding assets by over $5.7 million, the company faced an uphill battle in managing its debt obligations and financial commitments.

A closer look at the breakdown of liabilities exposed substantial priority claims secured by property, priority unsecured claims, and non-priority, non-secured claims, highlighting the complex financial web that Howard’s found itself entangled in. Additionally, the company's holding of aged accounts receivable and inventory posed challenges in maximizing recoveries through asset liquidation.

The decision to opt for a liquidating Chapter 11 bankruptcy route signaled the company's intention to wind down its operations and dissolve rather than restructure and continue as an ongoing entity. This strategic choice, although less common, provided insight into the management's decision-making amid mounting financial pressures.

Moreover, the bankruptcy filing highlighted the company's efforts to explore restructuring and cost-cutting measures in a bid to boost profitability. However, external factors like tariffs and consumer spending trends proved to be insurmountable hurdles, contributing to the company's ultimate decision to cease operations.

The statements made by the new owner, David Steinhafel, shed light on Howard's ambitious expansion strategy into new markets, which may have strained the company's financial health. Despite efforts to navigate challenges and return to profitability, Howard’s faced an untenable situation that led to the decision to liquidate assets and dissolve the business.

As the bankruptcy proceedings unfold, the court has granted approval for emergency motions, allowing for the swift liquidation of assets and settlement of creditors' claims. The auctioning off of inventory and fixtures from the retail stores signals the final chapter for Howard’s Appliance, marking the end of an era for the long-established retailer in Southern California.

In conclusion, the demise of Howard’s Appliance serves as a cautionary tale of the challenges faced by retail businesses in today's economic landscape. The company's bankruptcy filing and subsequent liquidation underscore the importance of adaptability, financial prudence, and strategic foresight in navigating turbulent market conditions.